SBI Pay App Registration

The SBI UPI app needs your mobile number for the registration. To get it and authenticate it would ask the permission for send an SMS from your number. Thus you must have enough balance to send the SMS. Also, you should choose the SIM/number which is register with the bank account. Give permission of sending SMS and making a call.

The SBI pay would capture your number and ask it to verify. Click ‘Yes’.

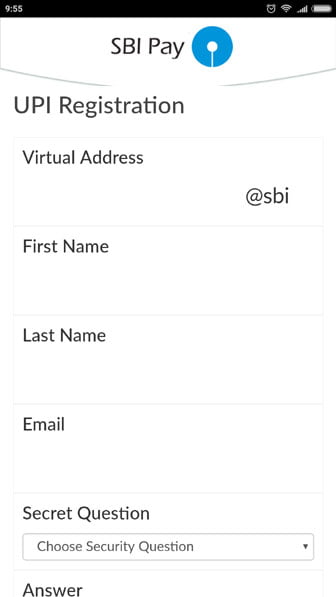

VPA Registration

Now you have to fill details for the VPA registration. It starts with the setting desired virtual payment address. You can choose the VPA of your choice subject to availability. To create a VPA, you have to click on add a bank account. In the next step, you are asked to choose a VPA. The VPA has two parts like an Email ID for example Kishore@SBI, 95678490@SBI. The suffix would be fixed word i. e. @SBI, while you can choose the Prefix. The prefix can be your name, phone number or anything you want. It is similar to the choosing email ID. The early registrant would certainly get good VPA.

Now you have to fill details for the VPA registration. It starts with the setting desired virtual payment address. You can choose the VPA of your choice subject to availability. To create a VPA, you have to click on add a bank account. In the next step, you are asked to choose a VPA. The VPA has two parts like an Email ID for example Kishore@SBI, 95678490@SBI. The suffix would be fixed word i. e. @SBI, while you can choose the Prefix. The prefix can be your name, phone number or anything you want. It is similar to the choosing email ID. The early registrant would certainly get good VPA.

Give your name, email address, security question-answer and choose the bank which has your account. Click on the checkbox of terms and condition. Submit the form.

In the next page, you would be shown the last few digits of your account number. Be assured and click on ‘Register’ With this your registration of VPA is successful. Virtual payment address is used in place of bank account and IFSC to get the money.

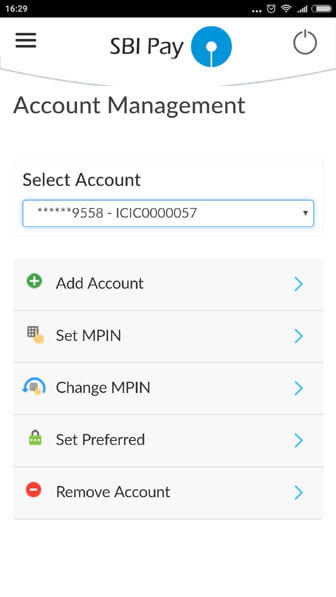

Set MPIN

Set MPIN

- To make a payment you require a MPIN. You have to set the MPIN by giving your debit card details.

- Go to the account management page, and select the desired account, if there is many. Click on Set MPIN.

- Give the last 6 digits of your debit card and expiry date.

- You would get an OTP to your registered mobile number. Enter this OTP into the given box.

- Input your desired MPIN. With this, you set the MPIN for an account.

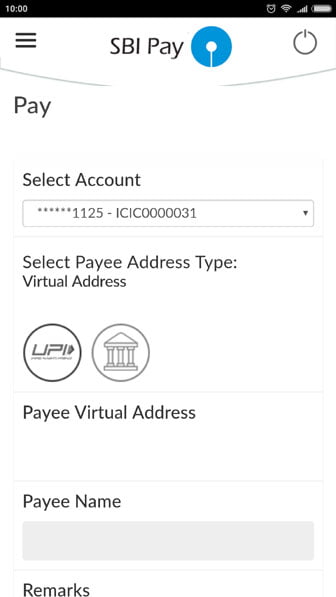

How To Transfer Money Using SBI UPI APP

How To Transfer Money Using SBI UPI APP

Transferring money through the SBI UPI App is as easy as sending an SMS. Follow these steps.

- Open the UPI-based app SBI Pay by entering 6 digit password. This is the same password which you have set at the time of SBI pay registration.

- Go to the ‘Pay’ section

- Select an account from the drop-down list. There can be many accounts if you have added more than one account.

- Select the payee address type. It can be a VPA or bank account number. If you choose the bank account, you must have the bank account number and IFSC code

- Input the VPA of a payee. It will take the payee name automatically. This also verifies the VPA.

- Enter remarks and payment amount. Click on the ‘Pay’

- In the next page, you have to enter the MPIN. Submit the MPIN.

- It is over, you have transferred the money.

It is very easy to send money through the UPI-based apps. The process is similar to all the UPI apps.

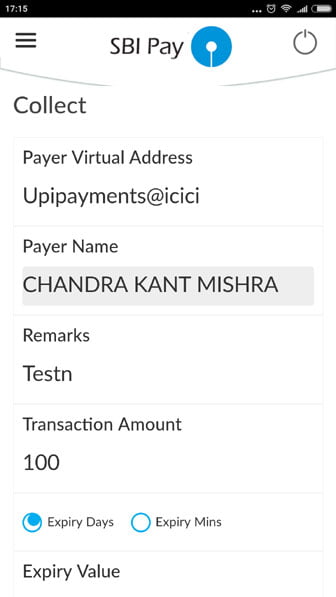

How To Collect Money using SBI Pay App

How To Collect Money using SBI Pay App

You can also ask money from anyone using the UPI app. It is a unique feature among many other benefits of UPI. To ask or collect money through the SBI Pay, you have to follow these steps.

- Login into the SBI UPI app

- Go to the ‘Collect’ section

- Enter the VPA of the person to whom you want money. The system will automatically take the name. Enter the remarks and amount.

- You can also choose the expiry days or expiry minutes if required.

- Click on ‘Initiate request’. You would get a confirmation of the collect request.

How To Pay For Online Shopping

You can also pay for online shopping using the UPI app. At the time of the payment, you would have the option to choose the payment through the UPI. For such transaction, you have to give only your VPA.

The online shopping site would ask money through the ‘Receive money’ facility of UPI. You can approve such payment after getting the product. It will also work as the Cash on delivery.

The Flipkart, Myntra and Jabong are working over this. Within few days you can see this payment option.

So, With the launch of SBI UPI app you can pay money to almost every bank account of India. It has made the money transfer very easy. However, I must say that SBI Pay is not the best UPI app. So, you can use the UPI apps of other banks.